Diffuse Value Capture

Published May 19th, 2025

1 Definitions

Diffuse: Widely spread out rather than concentrated; dispersed across many points, participants, or locations.

Direct value capture: many-to-one, closed, permissioned.

Diffuse value capture: many-to-many, open, permissionless.

Direct and diffuse value capture exist on a spectrum; extremes on either end are rarely workable.

2 Thought Experiment

Alice and Bob both work 30 hours per week creating a similar digital good. They aim to capture value in various forms, such as money and social capital.

| Alice | Bob | |

|---|---|---|

| Hours worked | 30 | 30 |

| Value created | 10 | 100 |

| Capture rate | 90% | 10% |

| Value captured | 9 | 10 |

Alice captures 90% of the value created, and Bob captures 10%, but Bob still captures slightly more value than Alice—one whole unit—with the same amount of work. This is effective diffuse value capture.

There is no upper limit to how much value one person can create. Producing 1,000 units and capturing just 1%, or producing 1,000,000 units and capturing 0.001%, can still yield meaningful returns.

3 Authorship & Originality

Authorship and originality also exist on a diffuse-to-direct spectrum.

For most of human history, cultural production was diffuse. People wrote stories based on other stories, and sang songs based on other songs. Authorship and originality were diffuse.

Before the printing press, works often circulated anonymously or under the names of famous figures to lend prestige. Scribes copied manuscripts freely and without permission. Because duplication was so labor-intensive, limiting copying wasn’t a practical concern.

Ideas about authorship and intellectual property were shaped by the current level of technology for reproducing information.

Since the introduction of the printing press, Western cultural production has become increasingly direct, culminating in the pre-internet era of Hollywood, television, music, and publishing.

At the peak of this direct cultural wave, the personal computer emerged, initiating a shift back toward diffuse cultural production—not as a return to pre-industrial models, but as new models made possible by decentralized global computer networks.

There was a 250-year gap between the European printing press and the establishment of modern intellectual property law. While cultural timelines have accelerated, there remains a persistent lag between technological change and cultural adaptation.

| Year | Tech/Event | Immediate Reaction | Lasting Legal Shift |

|---|---|---|---|

| 1040 | Bi Sheng (畢昇) invents movable-type printing in China | Modest adoption due to thousands of Chinese characters | Limited impact on Chinese legal frameworks for copying |

| 1450 | Gutenberg’s movable-type printing press | Explosion of vernacular Bibles, pamphlets; authorities panic over heresy. | None yet, copying suddenly cheap, rules nonexistent. |

| 1476 | Caxton sets up England’s first press | Crown issues ad-hoc printing patents, but enforcement is patchy. | Still no copyright—control via favors & guilds. |

| 1517 | Martin Luther’s Ninety-five Theses | Printed and distributed across Europe, sparks Reformation. | Demonstrates power of print to bypass traditional gatekeepers. |

| 1557 | Royal Charter for the Stationers’ Company | Guild monopoly lets Crown censor by licensing printers. | Corporate control substitutes for author rights. |

| 1662 | Licensing of the Press Act | Censorship tightens; printers need a license or face seizure. | Parliament grows wary of monopoly but has no alternative. |

| 1695 | Licensing of the Press Act Lapses | 14-year vacuum—anyone may print; pamphlet culture booms. | Chaos forces lawmakers in Parliament to rethink “who owns a text”? |

| 1710 | Statute of Anne | For the first time, authors, not printers, receive a 14-year exclusive right. | The birth of modern copyright—arrives 250 yrs after the printing press. |

| 1910 | Qing Copyright Code | Short-lived but modeled on European statutes | Real enforcement waited until the PRC’s 1990 law |

We are only at the dawn of the internet today.

4 Neo-China Arrives from the Future

“The seal stamps on old Chinese paintings are fundamentaly different from the signatures used in European paintings. Primarily they do not express authorship that might have authenticated the picture, therby making it unassailable. Instead, most seal stamps come from connoisseurs or collectors who inscribe themselves into the picture not only through their seal but also through their commentaries. Here art is a communicative, interactive practice that constantly changes even the artwork’s appearance. Subsequent viewers of the picture take part in its creation.”

—Byung-Chul Han, Shanzhai 山寨, 2017.

The diffuse-to-direct spectrum varies regionally. In the Far East, concepts of authorship and originality differ in ways that are not solely shaped by technology, but are deeply rooted in ancient Eastern religions and philosophies.

In Chinese thought, originality is not defined by a singular act of creation, but by an ongoing natural process—less about fixed identity, and more about continual transformation. Skillful reference signals depth of knowledge, and originality lies more in subtle recombination than in radical novelty.

In November 2023, DeepSeek-AI open-sourced its DeepSeek-LLM models, which already outperformed Meta’s Llama 2 on code and reasoning benchmarks. Fourteen months later, it unveiled DeepSeek-R1, a 671-billion-parameter model that matched GPT-4 on key metrics. The company reported a final training cost of under $6 million—far less than what U.S. flagships spend. Today, a 100GB download and a few consumer-grade GPUs are enough to run and fine-tune a frontier-class model at home.

Western incumbents still cling to a direct value capture mindset—API call metering, closed-source weights, NDAs—while Chinese labs treat the model itself as a form of advertising for downstream services, hardware, and prestige. A thin proprietary layer provides just enough coordination to serve as trading alpha for their AI quant funds.

This is diffuse value capture in action, arriving just as American IP maximalists and AI safetyists lose the plot, scrambling to monopolize and control the AI industry for short-term personal gain.

Western critics often portray China’s loose stance on intellectual property as a drag on innovation, but in an AI-driven century, it may prove prescient. Is it possible the West took the wrong path—and that ancient Chinese views on authorship and originality, rooted in naturalistic processes and continual transformation, will more closely resemble the IP norms of the 21st century? Less a God-like act of creation from a single source, and more like evolution itself.

The “Chinese century” might not be defined solely by GDP or rare-earth supply chains. It could be shaped by open-source abundance versus closed-source scarcity—by diffuse value capture rather than direct value capture.

China’s leadership still describes the country as moving toward communism. Beijing’s roadmap talks about deepening socialism with Chinese characteristics in two big steps—“basically realize socialist modernization” by 2035 and build a “great modern socialist country” by the middle of this century (2050). Given the Chinese aproach to authorship and originality, and the sucsess of DeepSeek, I think it is very likely that this looks like open-source adundance and diffuse value capture.

A useful lens here is Marx’s idea of the “general intellect,” which anticipates how collective knowledge—once embedded in machines and networks—can eclipse individual labor as the chief driver of growth.

Much of the failure of socialist experiments after Marx can be traced to attempts to solve problems created by direct value capture using even more direct value capture—replacing markets with bureaucracy and coercion.

In practice, neither direct nor diffuse value capture requires a totalitarian apparatus to enforce it. Capitalism has no aligance to closed proprietary systems, as evidenced by the rise of open-source software and the success of cryptocurrencies.

Because value increasingly comes from shared pools of code and models, efforts at direct capture—exclusive IP, closed weights—create friction, while diffuse capture unleashes information flow and strengthens the network.

5 Neural Networks are Diffuse

Contemporary culture, finance, and law are still skewed toward direct value capture—but recent advancements in AI are beginning to expose and intensify the longstanding flaws in this model. Neural networks are diffuse by nature; direct value capture does not map well onto them.

Art, music, code, design, and other cultural artifacts—culled from the open web—are diffused across latent space. Once creativity is encoded as a multi-trillion-parameter fog, the notion that you can meter each droplet of inspiration the way you once metered a DVD sale becomes economically and technically incoherent.

A neural network does not store information like a database storing rows. Any given weight is meaningless in isolation; value emerges only from the statistical interference of all weights acting in concert. Like pigments blended into paint, the original sources are no longer separable—you can’t point to a specific coordinate and say, “this vector belongs to that copyright holder.”

Listen to current conversations around AI and intellectual property and you’ll find little consensus on how to preserve the existing IP framework in this new era. Proposals for radical reform—once confined to the lunatic fringe—are now gaining traction in mainstream tech circles.

I agree

— gorklon rust (@elonmusk) April 11, 2025

The increasingly diffuse nature of cultural production—and the growing openness to new ways of thinking about intellectual property—is a direct consequence of technological trends:

-

The rise of decentralized networks over traditional media and finance.

-

Massively accelerated AI-driven content creation, built on a remix paradigm and inherently diffuse models.

-

Hyperfinancialization, which blurs the lines between leisure/consumption and labor/creation online.

This shift isn’t driven by political will or personal preference. Information “wants” to be free, just as water wants to flow downhill—a constant, unidirectional force that doesn’t reverse with each barrier it breaches. Efforts to restrict the internet may delay its progress, but they never succeed in stopping it—not in any timeline.

6 The Hacker Ethic & Free Information

The precepts of this revolutionary Hacker Ethic were not so much debated and discussed as silently agreed upon. No manifestos were issued. No missionaries tried to gather converts. The computer did the converting.

—Steven Levy, Hackers, 1984.

Computers speak in copies, and the cost of duplication is effectively zero. When the medium itself is infinite replication, economic models based on scarcity become increasingly difficult to maintain—the technology pulls toward abundance and sharing.

The architecture of computing encodes this “hacker ethic” at its core, much like how neural networks are diffuse by nature.

Artificial scarcity imposed by legal means in the digital realm is an awkward simulacrum of real-world scarcity. Forcing physical-world notions of property onto information systems creates endless friction and runs counter to the grain of the medium. This primal, often unspoken orientation at the heart of computing is what Richard Stallman later formalized as software freedom.

“We have already greatly reduced the amount of work that the whole society must do for its actual productivity, but only a little of this has translated itself into leisure for workers because much nonproductive activity is required to accompany productive activity. The main causes of this are bureaucracy and isometric struggles against competition. Free software will greatly reduce these drains in the area of software production. We must do this, in order for technical gains in productivity to translate into less work for us.”

—Richard Stallman, The GNU Manifesto, 1985.

Free software—and its defanged offshoot, open source—has been at the core of computing culture ever since. As a result, programming culture has adapted to the shift toward diffuse value capture more readily than most other industries. In contrast, neighboring professions have struggled to move beyond the 20th-century mindset of direct value capture, along with its emphasis on authorship and originality.

Even within programming culture, there’s a gap between those who create value and those who capture it. Bill Gates’s fortune dwarfs that of Linus Torvalds or Richard Stallman, despite the latter having contributed significantly more to computing and the world at large. In Gates’s famous Letter to Hobbyists, software is treated as a naturally scarce product—no different from hardware. The diffuse nature of software and its unique economic properties never enter the picture.

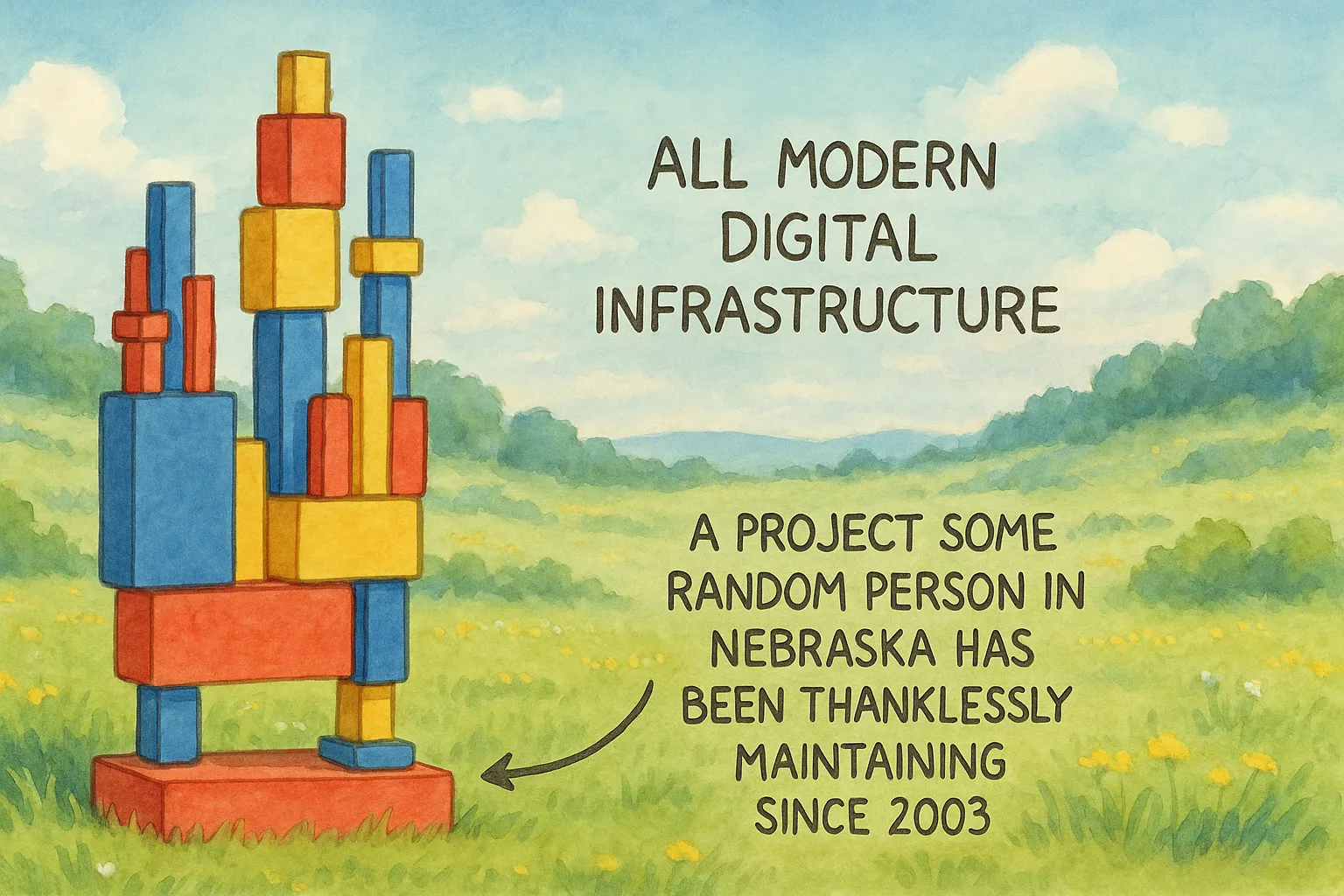

Despite its massive success, free and open-source software culture still struggles to develop effective systems for value capture and coordination. In many domains, it remains a niche—often relegated to controlled opposition, hobby projects, unpaid or underpaid labor, résumé padding, or pawns in commoditize-your-complement strategies. The ecosystem continues to grapple with how to natively and diffusely capture value and coordinate production on its own terms.

Corporate patronage has been a primary driver of open-source development and one of the main ways value is captured from it. However, the direct value capture systems used by big tech sometimes run counter to the diffuse nature of open-source.

Many current forms of corporate patronage tends to be direct. Involving layers of bureaucracy and middlemen, with everything needing to be accounted for in ways legible to middle managers. This can create blind-metric behavior, where open-source developers chase arbitrary KPIs rather than focusing on actual value creation. It can slow down development and add friction to the open, collaborative ethos of open-source.

Once an open-source developer becomes integrated into direct value capture systems, they’re often incentivized to gatekeep their work to preserve personal advantage. This can reduce incentives to share knowledge, mentor others, or collaborate openly—qualities that make open-source so powerful.

Diffuse value capture strategies try to better align incentives with openness and collaboration. The more knowledge you share and the more you help grow the ecosystem around your project, the more value you can ultimately capture. While some degree of gatekeeping is necessary to protect community culture, the unproductive information asymmetry and cronyism produced by direct value capture systems are less financially incentivized in diffuse models.

With diffuse value capture the hacker ethic becomes fully aligned with financial incentives and competition at the highest levels of the market—where previously, it stood in tension with direct value capture.

The coordination mechanisms required to compete with companies like Apple and Nvidia as fully open-source organizations remain elusive. Still, the dream of “the year of the Linux desktop” refuses to die, and projects like Blender have managed to thrive—and nearly dominate their niche—despite chronic underfunding.

One notable exception is crypto. Open-source and diffuse by nature, it has created and captured a staggering amount of value. Yet it remains controversial and underutilized in many free and open-source software circles.

| Rank | Asset | Market Cap | Type |

|---|---|---|---|

| 1 | Gold | 21.7T | Physical Commodity |

| 2 | Microsoft | 3.3T | Technology |

| 3 | Apple | 3.1T | Technology |

| 4 | NVIDIA | 3.0T | Technology |

| 5 | Amazon | 2.2T | Technology |

| 6 | Bitcoin | 2.0T | Open-Source Commodity |

| 7 | 1.9T | Technology |

It’s notable that Google—the company behind the “Attention Is All You Need” paper that helped ignite the current AI hype cycle—now has a market cap smaller than a decentralized, open-source project with an anonymous founder. This market signal suggests something interesting about how value flows in an increasingly digital economy. While traditional tech companies navigate the challenges of direct value capture, cryptocurrencies are, surprisingly, defying many of the failure modes typically associated with open and decentralized projects. What’s going on here?

7 Crypto & Diffuse Value Capture

Satoshi started a fire in cyberspace. While the fearful run from it and fools dance around it, the faithful feed the flame, and dream of a world bathed in the warm glow of cyberlight.

—Michael Saylor

Technology should be deflationary—every efficiency and automation ought to push prices down in a competitive free market. Yet almost all goods and services feel noticeably more expensive each year. Why is that?

In the United States, the broad money supply (M2) grew by roughly 40% between early 2020 and early 2025, masking the natural price reductions that technology and automation would otherwise deliver. To preserve purchasing power, simply saving in a hard-money asset—one with a fixed supply—like gold or Bitcoin offers a bureaucracy-free way to diffusely capture value from technological progress.

Gold’s main weakness as money is that it only solves scarcity—not speed or security in a digital world. It’s heavy to ship, difficult to divide finely, and costly to verify. As a result, people store it in banks and transact using paper or electronic claims instead. But that custody layer reintroduces the very counterparty risk, government control, and inflation-by-decree (via unbacked IOUs) that gold was meant to eliminate—while still exposing holders to confiscation and inflation via mining. A purely digital, finite asset like Bitcoin avoids all of these problems.

Like gold, Bitcoin has many advantages over real estate. Houses are non-fungible, non-transportable, non-divisible, and not instantly liquid. Ownership is taxed, maintenance is an ongoing cost, and there’s always the risk of natural disasters or other catastrophes.

When single-family homes become a store of value, a monetary premium gets added on top of their use value as shelter. People end up paying more than necessary just to secure basic housing. This dynamic harms diffuse value capture in a crucial way: affordable housing frees people to pursue less directly profitable activities—maintaining independent open-source software, inventing new technologies without restrictive IP, or creating experimental art.

We’ve seen this cycle in cultural hubs like New York City and Berlin. Low-cost living initially enabled vibrant scenes of art, music, and experimental technology. These diffuse activities made the cities desirable, creating a positive feedback loop—until rising housing costs pushed out the very creators who made those places attractive, replacing diffuse innovation with direct value extraction.

Many real estate investors are simply wealthy individuals seeking capital preservation. But if Bitcoin and other cryptocurrencies offer better long-term stores of value than real estate, shifting capital from housing to crypto could serve a dual purpose: preserving wealth while removing monetary premium from housing. This would be a boon for both diffuse value capture and housing affordability—a major quality-of-life issue for millions.

”I’m going to list this median house for 3x what the median family can afford.” pic.twitter.com/TCW9XeV8Q2

— Darth Powell (@VladTheInflator) April 15, 2025

A slightly more advanced form of diffuse value capture than gold or real estate is the use of S&P 500 ETFs and the Boglehead investing strategy. These approaches allow individuals to capture value from the economy as a whole with minimal bureaucracy and few middlemen. Whatever value you create but fail to capture directly may be absorbed by companies like Google or Microsoft—and broad market exposure lets you reclaim a portion of it.

However, the S&P 500 faces a similar issue to real estate: it’s increasingly used as a store of value and an inflation hedge, rather than the original purpose of equities—investing in innovative companies. As a result, equities can accrue a monetary premium beyond their speculative value, artificially inflating prices and distorting the market. This dynamic can make market data less meaningful and extend the lifespans of companies that have ceased to innovate, preserving stagnant bureaucracies long past their prime.

Is Apple in 2025—long after the era of Steve Jobs—still a strong speculative investment worthy of a $3.1 trillion market cap? How much of Apple’s valuation reflects genuine belief in its capacity to innovate, and how much is simply driven by ETFs parked in retirement accounts?

What if the stock market could refocus on its original purpose—funding innovation—rather than increasingly functioning as a store of value dominated by established incumbents?

The equity market presents numerous challenges to diffuse value capture. Many of the best investment opportunities—such as private equity and venture capital—are inaccessible to the average person. These markets are heavily gatekept: to participate, you must be an accredited investor, meet minimum income or net worth requirements, and afford high minimum investment thresholds. In practice, the public market often serves as a way for private equity to sell to the public after most of the returns have already been captured by wealthy insiders.

Even today, the average American can’t invest in most leading AI companies like OpenAI or Anthropic. Retail investors seeking AI exposure are pushed into proxies like NVIDIA—but buying NVIDIA stock is essentially a bet on its proprietary, direct value capture strategy, not on AI itself, which has the potential to unlock technologies capable of disrupting previously stable value capture moats like NVIDIA’s.

In the U.S., individuals are allowed to buy lottery tickets and gamble at casinos, yet are “protected” from accessing early-stage startup equity—supposedly for their own good. The traditional financial system is simply too closed, proprietary, and gatekept to enable diffuse value capture at the scale demanded by AI and other emerging technologies.

To me, it’s clear that global capitalism now requires open, fair, permissionless, and 24/7 financial infrastructure.

After Bitcoin’s success, many new blockchains emerged, featuring smart contracts and decentralized applications with the potential to replace the traditional financial system with open-source infrastructure—much like open-source software replaced proprietary software in the server-side battle in the 1990s.

These systems are open and diffuse by design. Just as computers are inherently aligned with free information and effortless copying, and neural networks are diffuse by nature. The diffuse-to-direct orientation of the upstream infrastructure often has downstream effects on how the technology is used, making programable blockchains like Ethereum more condusive to diffuse value capture.

If Bitcoin is digital gold, then Ethereum functions more like a public world computer. Ethereum lets anyone deploy a programmable token (an ERC-20 smart contract) that is immediately tradable on open, permissionless exchanges. Holders can pool two tokens in an automated market-maker like Uniswap, set (or accept) a swap fee, and earn a share of that fee for supplying liquidity—no bank or broker in the loop. The yield that banks normally pocket on deposits flows straight back to participants, a textbook case of diffuse value capture.

While finance is Ethereum’s most developed use case, its potential extends far beyond. As a general-purpose platform, Ethereum is also a fertile ground for cultural experimentation. One of the highest-market-cap tokens on the Ethereum blockchain isn’t tied to finance at all, but to internet culture: 0x6982508145454ce325ddbe47a25d4ec3d2311933, $PEPE.

Pepe the Frog is a prime example of the shift from direct to diffuse culture. The character was created by Matt Furie in 2005 as part of his comic Boy’s Club. Pepe’s origin followed the traditional model of direct culture: a single creator and copyright holder with full control over the character and its world.

However, it’s worth noting that Matt Furie’s art style is a psychedelic blend of the media consumed by Gen X and Elder Millennials growing up in the 1980s that often dosn’t try very hard to disgues it’s influences. His work evokes distorted echoes of pop culture icons—Jim Henson’s Muppets, Ronald McDonald, Skeletor, Freddy Krueger, the Ninja Turtles, or Falkor from the Never Ending Story—all diffused through Furie’s own surreal lens. In this way, he represents an interesting checkpoint in the transition from direct to diffuse culture.

This highlights a core tension in direct value capture systems: at some level, everything is a remix. Yet direct value capture requires a certain level of abstraction away from source material to meet legal and social requirements for originality—asserting authorship and ownership over what is, in practice, always partially derived.

The Pepe the Frog character became an internet meme as his popularity steadily grew across platforms like Myspace, 4chan, and Tumblr starting in 2008. By 2015, he had become one of the most widely recognized memes on the internet. Pepe began evolving in a decentralized, memetic fashion—without a central authority and entirely outside the intent of his original creator.

This culminated in Pepe becoming accociated with and widly used by various extreamist political groups, prompting Matt Furie to use his copyright in an attempt to stop the character’s use. While Furie achieved some legal successes, the character ultimately had completly escaped his control. Pepe took on drawing styles and lore with no single author, he just continued evolving online, even morphing into versions so different from the original that they took on other names and identities.

The nature of the internet made containment impossible. In an interview with Esquire, Furie said of Pepe’s use as a hate symbol: “It sucks, but I can’t control it more than anyone can control frogs on the internet.”

In late April 2023, during a crypto bear market following the collapse of FTX, a PEPE memecoin was launched on Ethereum and quickly reached a market cap of 1.6 billion by early May. Today it has a market cap of 5.5 billion—down significantly from its all-time high of 11 billion in late 2024.

I was closely following the token at the time, and what I saw was a glimpse of crypto’s potential as a diffuse value capture system. The memecoin functioned as a minimal viable coordination and incentive mechanism layered on top of a diffuse cultural phenomenon.

Anyone holding the token could create content for it without permission, and if the content got enough attention, the token would go up in value, like a basic attention market. It created an incentive structure for propogating the meme.

Crypto has a concept of “working for your bags”. In tradional wage labor a massive amount of time is spent simply trying to get the next job. But in crypto, you can buy an assets you think is undervalued without permission, and imediatly get to work in the open community around it.

This can be as simple as making memes and content on a site like Twitter/X, or can look more like a real job, such as buying a crypto token for some open-source technology or protocol and working to improve it on GitHub and talking about it on social media.

This is already something that happens with equities, people that own a lot of Apple stock tend to own Apple computers, and they are incentavized to promote them and ignore their flaws due to finacial intrest. Crypto allows this to happen in a much more fine grained way.

In the early days of PEPE, almost every night there were long Twitter spaces full of 1000s of people talking about PEPE. The energy was electric, hosts would sometimes just play Jungle music and everyone would spam green hearts. This was of couse all very juvinile and silly, but most interesting technology looks like that at first.

Blockchains currently have a lots of problems that prevent mainstream adoption, but think a likly future is that almost all Linux distros and open source software projects will have crypto assets accociated with them. This will create valuable real time 24/7 market data for the global open-source ecosystem.

8 Post-Authorship

The obsession with authorship and originality that results from an over-reliance on direct value capture has become a weight dragging down creativity, collaboration, production incentives, and mental health.

We’ve built a world where the path to success is to isolate, own, control, and defend infinitly copyable intangible ideas. This is not only at odds with how culture and technology actually evolve—it actively suppresses the social and memetic nature of cultural production.

Pay attention to design related social media and you will see an endless parade of people complainging about other people stealing their work, recently over things as trivial and obviously un-ownable as color gradiants. At the same time the quality of design in the everyday world degrades beacuse the presurses of direct value capture push designers to become expressive artist autures instead of visual systems engineers. So our visual environment degrades into expressive slop replaceing the dignaty and beauty of functional authorless late modernism.

The Satie graphic is just the font Ogg Regular with the i changed to Ogg Regular Italic, plus a little bit of tracking…https://t.co/XtOXnRN6jE https://t.co/i59g2tbP5P

— Eli Heuer (@eliheuer) November 30, 2023

The increased importance of identity politics, specifically in universities and professional-managerial class circles between the 2010s and 2020s has exacerbated the tendency of direct value capture systems to over focus on identity and authorship.

In August 2021, the NFT PFP Milady was launched on Ethereum. This was a project that was designed to be diffuse from the start, licened under the VPL, a simple copyleft license that allows anyone to make a derivative work without permission, but also requires that derivative works be licensed under the same terms. The project invited a kind of ARG-like game where anyone can make and sell derivative NFT collections, and the PFP became a kind of license to have fun online that freed wearers from the stifling preasures of identity and authorship. The comunity encourged stealing tweets and wearing NFTs you didn’t own. Where Pepe foreshadowed the loss of authorial control, Milady formalized it as a design principle.

One of the key people behind the project was Charlotte Fang, who wrote many blog posts and tweeted art critisism at the time. He wrote a blogpost called “Unpacking Post-Authorship” in 2022 which formailized the idea of post-authorship as a new way of thinking about art and design after blockchain and AI. It offered an alternative to the increasigly stifling identity and authorship culture of millenial profesionals and legacy art and design institutions:

1. Remixing is the natural mode of artmaking online; introducing any friction to process materials damages the sum art output of the community,

2. Social mores of accreditation and permissioned remixing hinder a works ability to propagate (intact or remixed) reducing its memetic fitness; anonymizing work is often its liberation, and

3. Art comes from the beyond & not in isolation; as the artist serves only as handmaiden to higher consciousnesses, it’s hubris to be entitled to its bounties especially at the expense of its memetic fitness.

Accepting the death of authorship recognizes and rejects the social mores that hamper an ability to freely use, modify and propagate artist’s work. However, it should be clear it’s not necessarily a radical commitment to anti-authorship in all instances. It is true that artists imprint their personal interpretation of the divinity they channel (secular: zeitgeist, collective unconsciousness, so accreditation, especially in the context of canonization, is very often relevant, e.g. to trace a chronology of work to best understand it in reflection with an on-going practice.

—Charlotte Fang, Unpacking Post-Authorship, 2022.

While the authorhip and indentity obsesed art and design world faught over scraps thown to them by legacy institutions, and endured low-pay, unpaid internships, and other forms of degradation, the Milady community was making money and having fun online. The all-time high floor price for Milady NFTs was 7.8 ETH ($20,000 USD at the time), which occurred around May 10-11, 2023, following a tweet by Elon Musk featuring a Milady. Unauthorized derivative works were being made and sold by the thousands. Many of the collections featured AI generated images. At one point Vitalik Buterin even wore a Milady NFT as his Twitter/X profile picture.

The GPL was never intended as anti-commercial—Richard Stallman explicitly designed it to enable business models built on free software. Companies could sell support, customization, hosting, or integration services while the code itself remained free. Red Hat proved this model could work, building a multi-billion dollar business on open-source software.

But these traditional open-source business models still rely on somewhat direct value capture—selling services to specific customers through conventional contracts. They’re missing what might be the final piece of the GPL/copyleft vision: a native, diffuse economic layer that aligns with the license’s viral, collaborative nature. Just as Linus Torvalds provided the missing kernel that made GNU tools a complete usable operating system, crypto markets, with much of their base level protocols and culture being copyleft oriented, might provide the missing economic infrastructure that makes copyleft a complete economic system.

Imagine if every GPL project had an associated token that automatically appreciated with adoption and improvement. Contributors would be incentivized to enhance the commons rather than fork it for proprietary advantage. Users could invest in the tools they depend on. The same viral property that makes GPL code spread could make economic value flow back to creators—diffusely, automatically, without gatekeepers.

This isn’t a rejection of the GPL’s principles but their fulfillment. When Stallman wrote about reducing “bureaucracy and isometric struggles against competition,” he was describing inefficiencies that blockchain-based coordination could actually solve. The infrastructure for this future already exists. What’s missing is cultural acceptance—the willingness to see crypto not as unserious speculation but as the economic layer copyleft licensed projects always needed.

Many programmers and designer are financially incentivised to work in proprietary models on large projects they have little authorship over. What if we could partially recreate those incentives in permissionless independent open-source projects?

Their design assumes memes = an individual viral post, eg a specific funny tik tok, rather than call & response remixed cultural virus, eg an evolving tik tok fad. Incredible millennial brainrot. They accidentally built a very poor, ultra thin prediction market on post engagement

— ♡ Charlotte Fang 🪲 Crown Prince ❀ LOVE HEALS 💞 (@CharlotteFang77) April 19, 2025

I belive there is a lot of potential in using crypto incentives with post-authorship ethos to create learge-scale ambitious open-source projects that were previously impossible.

9 Incentivizing Post-Authorship Commons-Based Peer Production.

“There is no reason to believe that bureaucrats and politicians, no matter how well meaning, are better at solving problems than the people on the spot, who have the strongest incentive to get the solution right.”

—Elinor Ostrom

“Even a billion dollars of capital cannot compete with a project having a soul.”

—Vitalik Buterin

Commons-based peer production, a term Yochai Benkler introduced in 2002, describes large, networked collaborative projects like GNU/Linux, Ethereum, Wikipedia, and SETI@home. These projects have less rigid hierarchies than traditional businesses, but Benkler’s core insight is that commons-based production doesn’t propagate proprietary knowledge. Everything created remains equally available for anyone to use, remix, and extend.

Post-authorship removes many barriers to collaboration and coordination that I believe have held back commons-based peer production, specifically the more cultural areas like art and design. When contributors stop worrying about who owns what idea, energy shifts from defending territory to building together, unlocking long-tail innovation.

Once the first copy of a program, video, or AI model exists, duplicating it costs almost nothing. Competitive pressures, piracy, and open-source alternatives drive prices towards the marginal cost of production, making the long-run price of digital goods effectively free. In this environment, diffuse value capture often outperforms direct approaches like paywalls, DRM, and legally enforced artificial scarcity. Incentives aren’t abolished but rewired.

The printing press took two and a half centuries to produce modern copyright. Blockchains and AI may need only decades to retire it. The rails for diffuse value capture are already in place, cultural norms just need time to catch up.

Colophon

This post is typeset in Bezy Grotesk, a free and open-source font designed by Eli Heuer, the essays author. It is built on the authorless memetic commons of the Internatinal Typographic Style and the work of many other designers, both known and unknown.

Eli’s Blog

Eli’s Blog